Getting The Hard Money Atlanta To Work

Wiki Article

The 25-Second Trick For Hard Money Atlanta

Table of ContentsExamine This Report about Hard Money AtlantaThings about Hard Money AtlantaHow Hard Money Atlanta can Save You Time, Stress, and Money.Unknown Facts About Hard Money AtlantaThe Ultimate Guide To Hard Money Atlanta

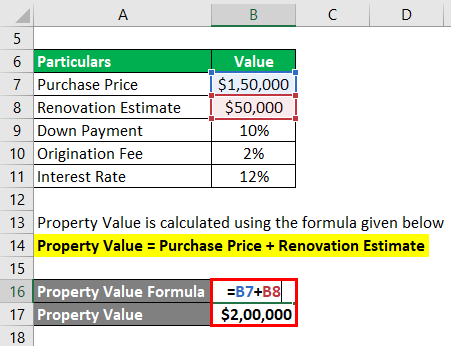

, are temporary borrowing tools that actual estate investors can use to finance an investment task.There are 2 main disadvantages to think about: Hard money lendings are convenient, yet financiers pay a price for borrowing this means. The price can be up to 10 percentage factors higher than for a conventional loan.

The Greatest Guide To Hard Money Atlanta

Again, lending institutions may permit investors a little bit of leeway right here.

Hard cash car loans are an excellent suitable for rich financiers that require to get financing for a financial investment building rapidly, with no of the red tape that accompanies financial institution financing (hard money atlanta). When examining tough money loan providers, pay attention to the charges, rate of interest, and finance terms. If you end up paying way too much for a tough cash car loan or reduce the settlement period too short, that can affect just how profitable your realty endeavor remains in the future.

If you're looking to buy a home to flip or as a rental property, it can be challenging to get a conventional home loan - hard money atlanta. If your credit history isn't where a typical lender would like it or you need cash much more swiftly than a lending institution has the ability to give it, you can be unfortunate.

The 5-Minute Rule for Hard Money Atlanta

Difficult money car loans are short-term guaranteed fundings that use the residential or commercial property you're purchasing as security. You won't locate one from your financial institution: Difficult cash financings are used by alternative lenders such as specific financiers and also personal companies, that usually neglect sub-par credit report and other monetary aspects as well as rather base their decision on the property to be collateralized.Tough money financings supply several advantages for borrowers. These consist of: From beginning to end, a difficult money financing might take simply a couple of days. Why? Difficult cash lenders have a tendency to place the original source more weight on the worth of a residential property used as security than on a consumer's financial resources. That's because tough money loan providers aren't called for to follow the exact same laws that typical lenders are.

It's key to think about all the hazards they expose. While hard cash financings featured advantages, a debtor must likewise take into consideration the threats. Among them are: Hard cash loan providers generally charge a higher rates of interest since they're thinking even more danger than a standard lending institution would certainly. Once more, that's as a result of the threat that a tough cash lending institution is taking.

Fascination About Hard Money Atlanta

Every one of that includes up to indicate that a tough money linked here car loan can be a pricey method to borrow cash. hard money atlanta. Choosing whether to obtain a hard cash financing depends in large component on your scenario. In any type of instance, make certain you consider the threats as well as the prices before you authorize on the dotted line for a difficult money financing.You definitely do not want to lose the car loan's security since you weren't able to stay on par with the regular monthly repayments. In enhancement to shedding the possession you advance as security, back-pedaling a hard cash lending can lead to significant credit report score injury. Both of these outcomes will leave you worse off economically than you remained in the initial placeand may make it a lot harder to obtain once again.

Some Known Facts About Hard Money Atlanta.

It's essential to consider variables such as the loan provider's online reputation and also rate of interest. You may ask a trusted realty representative or a fellow house flipper for recommendations. When you've pin down the right tough money loan provider, be prepared to: Create the deposit, which commonly is heftier than the deposit for a standard home loan Collect the needed documents, such as evidence of revenue Potentially employ an attorney to review the regards to the finance after you have actually been accepted Map out a technique for paying off the funding Equally as with any kind of financing, examine the benefits and drawbacks of a hard money loan prior to you commit to borrowing.No matter what sort of loan you pick, it's most likely an excellent suggestion to inspect your totally free credit report and also free credit history record with Experian to see where your finances stand.

(or "exclusive money loan") what's the very first point that goes through your mind? In prior years, some negative apples stained the hard money providing market when a few aggressive lending institutions were trying to "loan-to-own", supplying very high-risk car loans to borrowers utilizing genuine estate as security as well as meaning to foreclose on the homes.

Report this wiki page